Monzo Bank: A Comprehensive Guide & Insights - Explore Now!

Is the future of banking truly here, and if so, what does it look like? Monzo, a digital bank born in the heart of London, England, in 2015, is betting on a resounding "yes," challenging the established order and attracting millions of customers with its innovative approach.

The traditional banking landscape, once dominated by brick-and-mortar branches and lengthy processes, is undergoing a seismic shift. Monzo, alongside other digital pioneers, is at the forefront of this revolution, promising convenience, simplicity, and a banking experience tailored to the modern world. But what exactly makes Monzo tick? And how has it managed to capture the attention of a demanding customer base? Let's delve into the inner workings of this digital disruptor, exploring its key features, its unique selling points, and the challenges it faces in an increasingly competitive market.

Monzo's journey began with a simple, yet ambitious goal: to overhaul the traditional banking industry. Founded in London, England, the digital bank sought to provide a more transparent, user-friendly, and efficient banking experience. The founders envisioned a world where banking was not a chore, but a seamless, intuitive part of everyday life. Their vision was to build a bank that prioritized the needs of its customers and embraced the potential of technology to create a superior financial product.

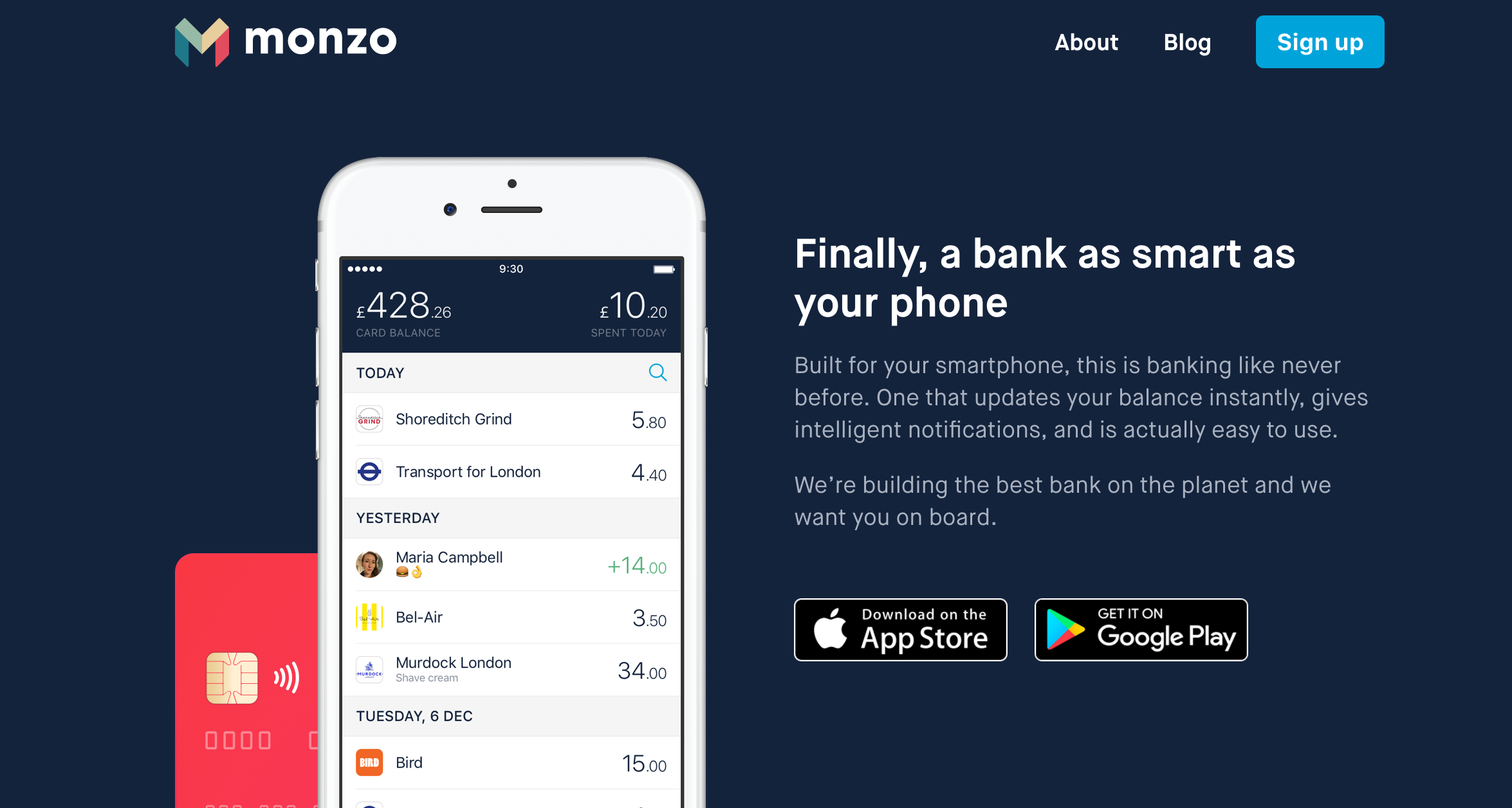

At its core, Monzo is a branchless digital bank. This means that, unlike traditional banks, it doesn't have physical branches. Instead, all customer interactions take place through a mobile app. This allows Monzo to offer a more streamlined and cost-effective service. One of the first things users notice is the speed and ease of account opening. Customers can open an account within minutes, a stark contrast to the often lengthy and cumbersome processes of traditional banks. Instant payment notifications are another hallmark of the Monzo experience, providing users with immediate insights into their spending habits.

Beyond its core banking features, Monzo offers a range of innovative tools designed to help users manage their finances effectively. "Savings Pots" allow customers to automatically set aside money for specific goals. The app also facilitates easy bill splitting with friends and family. These features, coupled with a user-friendly interface, have helped Monzo build a strong following, with 81% of Monzo's customers recommending the bank to friends and family.

Monzo's unique selling point is a combination of convenience, simplicity, and community engagement. By focusing on these aspects, the bank has built a loyal customer base and fostered a strong brand presence. Monzo actively seeks feedback from its customers, using it to improve its products and add new features. This collaborative approach has created a sense of ownership among users and has been instrumental in driving growth. As a modern financial institution, Monzo offers a wide range of banking services, including international transfers. To enable these transfers, Monzo has been assigned a swift code.

- Travis Kelces Return Super Bowl Emotions Chiefs Updates

- Chadwick Boseman Biography Roles Black Panther Legacy

The UK banking industry is known for its robustness and innovation, being home to some of the most trusted and advanced financial institutions globally. But the path to success hasn't been without its challenges. Like all digital banks, Monzo faces the task of building trust and security. Data security is paramount, and Monzo has invested heavily in ensuring the safety of its customers' funds and personal information. Furthermore, competition in the digital banking space is fierce, with new players constantly emerging. Monzo must continue to innovate and differentiate itself to maintain its position as a market leader.

To understand the scale of Monzo's operations and its place in the European digital banking landscape, consider these insights. According to data, monthly downloads of leading digital banking apps in Europe, including Monzo, have shown steady growth since January 2015, underlining the increasing demand for digital banking solutions. Financial data also reveals the largest digital banks in Europe in 2025, by funding amount. This further highlights the dynamics of the market and the position of Monzo. To enable these transfers, Monzo has been assigned a swift code. Monzo bank limited is a company registered in england and wales (no.09446231). Monzo bank limited is authorised by the prudential regulation authority and regulated by the financial conduct authority and the prudential regulation authority. Our financial services register number is 730427. Our address is broadwalk house, 5 appold st, london.

Another area of note is its marketing strategy. Monzo has built a strong brand by focusing on user engagement, customer service, and transparency. The bank's social media presence is active and engaging, and it actively encourages customer feedback. By fostering a strong community, Monzo has created a loyal customer base that acts as an advocate for the brand.

Monzo's impact extends beyond the UK. The rise of digital banking is a global phenomenon, and Monzo is well-positioned to expand its services to new markets. The company is part of a larger trend where financial technology companies are reshaping the industry, offering customers more choices and control over their finances.

Its important to note that, Monzo, trading as Monzo (\/ \u02c8 m \u0252 n z o\u028a \/), is a British online bank based in London, England. Monzos marketing strategy case study explore how they have successfully acquired new quality users, increased user engagement, and built a strong brand presence.

Monzo's model is straightforward: a digital-first approach, with no physical branches. This enables lower operating costs and a more user-friendly experience. The app is the centerpiece, offering instant payment notifications, spending categorization, and budgeting tools. Customers can open accounts quickly, and the platform is designed for ease of use.

However, there are considerations. As a digital bank, Monzo relies on technology. This means that it must be robust and secure. As well, the lack of physical branches could be a drawback for some customers. Moreover, competition is fierce in the digital banking space. Several other players like N26 are vying for customer attention. N26 is the leading neobank in Germany. Founded in 2013 by Valentin Stalf and Maximilian Tayenthal, the bank holds a comprehensive European banking licence and now operates in 25 diverse markets, including Barcelona, Madrid, Milan, Vienna and Paris. It also operates outside of Europe with markets in latam, including the brazilian city of So Paulo.

To put it simply, Monzo is playing a vital role in shaping the future of banking. By emphasizing user experience, community engagement, and technological innovation, it is leading the charge towards a more convenient and customer-centric financial future.

- Unveiling Fleece Johnsons Story The Booty Warrior Saga Updates

- Is Jay Leno Alive Debunking The Did Jay Leno Pass Away Rumors

What Is A Monzo Account A Comprehensive Guide To The UK’s Leading Digital Bank

What Is A Monzo Account A Comprehensive Guide To The UK’s Leading Digital Bank

Monzo Bank A Comprehensive Guide To The UK's Leading Digital Bank